There’s a long list of unpleasant things most business owners would rather do than bank reconciliation. Traditionally, it’s mindless and time-consuming. However, the bank reconciliation functionality within Xero feels more like a videogame than work.

The foundation of the financial web, a network of organizations sharing financial data, is bank statement feeds. Small business owners, working in the cloud, now expect their bank transactions to arrive automatically loaded in their accounting software when they start work each morning. Young entrepreneurs are doing bank reconciliations on their mobile phone while riding the train or standing in line for coffee. Integrated banking and accounting upends traditional accounting workflows from the end of the month catch-up, to a real-time view of cashflow.

You and your clients will love Xero bank reconciliation. Here’s a closer look at how it works.

Reconcile

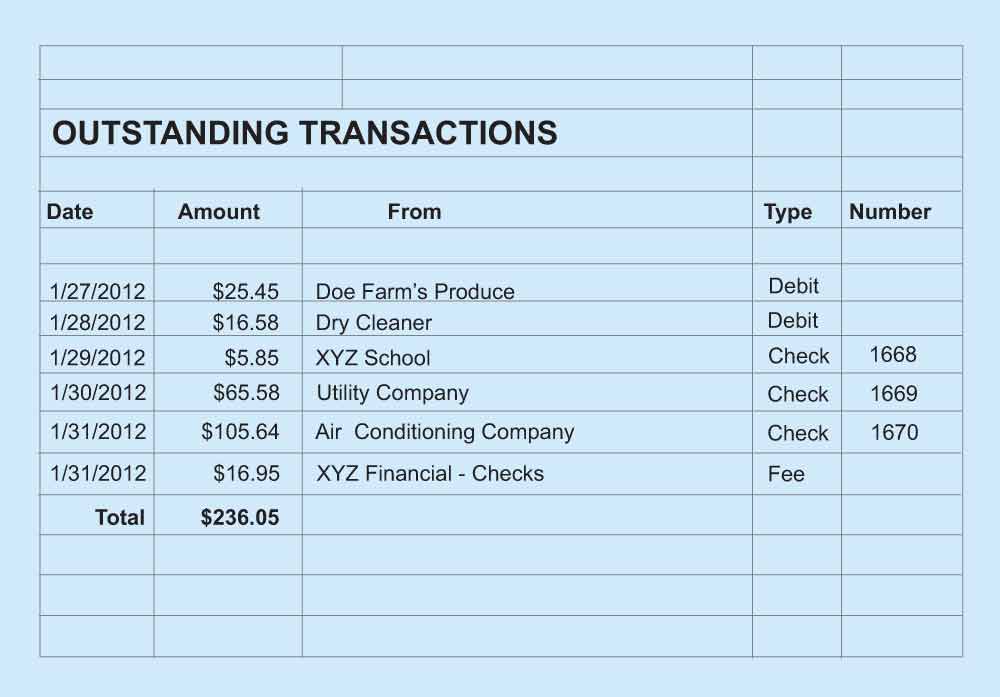

Once transactions are imported into Xero, whether through a bank feed or a file upload, Xero first automatically matches the bank transactions to any corresponding ledger transactions by exact dollar amount. To confirm the match is correct, the user simply presses the “OK” button and the transaction is reconciled. In the case of an outstanding invoice and a deposit of the same amount, simply clicking the “OK” button will clear the unreconciled bank line, debit cash, credit accounts receivable, and mark the invoice as “Paid.”

If Xero is unable to match based on dollar amount, it will then apply any bank rules. The contact, account coding and reference will be suggested, then applied with one click. In my opinion, bank rules are the single most effective tool for building automation in bank reconciliation because they will populate on the Bank Reconciliation screen, within Cash Coding and in the mobile app, Xero Touch.

Failing an automatic match or the application of a bank rule, if the “suggest previous entries” function is turned on, then Xero will suggest creating a transaction based on a previously reconciled transaction with similar details. For example, when Xero sees that there is a draw on the bank account for the same amount each month that has been previously coded to Bank Service Fees, Xero will make that suggestion going forward.

Cash Coding

The Cash Coding tab displays unreconciled bank statement lines horizontally in a spreadsheet format, which can be sorted by column headings to group similar items together. Users can easily batch-categorize transactions by selecting, completing the details for the first line and the rest will follow suit. View or hide statement lines with suggested matches to ensure that you are not cash coding something that should be matched to an invoice instead. Bank rules will populate on the cash coding screen, meaning that you can bulk reconcile dozens of transaction lines with one click. As you work, you can create bank rules directly from Cash Coding without losing your place.

Real-Time Data

It wasn’t that long ago that accountants and bookkeepers had to wait until the end of the month, quarter or even year to process the daily activity of small businesses. With Xero and bank feeds, you can build efficiencies in bank reconciliation that have never before existed. Bank reconciliation can be done in four-minute, instead of four-hour, chunks. Daily data coding is easy, and dare I say, FUN?

Our advice to clients is only as good as the data that it’s built on. With real-time bank reconciliation, I can look at my client’s sales today, determine that sales are down on red pencils, and suggest that tomorrow she offer a promotion on red pencils. No waiting until end of month reports. That’s powerful.

The layout of Xero’s bank reconciliation functions are clean; and with the ability to reconcile at the click of a button anywhere, anytime, bank reconciliation becomes almost addictive. Don’t say you weren’t warned.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs